A Comprehensive Guide to Navigating Offshore Service Formation Effectively

In the world of worldwide entrepreneurship, creating an overseas organization provides both elaborate challenges and unique opportunities. Picking the ideal territory is the first critical step, requiring a cautious equilibrium of lawful security, favorable tax obligation plans, and financial protection. As possible financiers browse with the complexities of legal and governing structures, recognizing the nuances of each can make a substantial distinction in the successful establishment and durability of an overseas entity. What adheres to are essential factors to consider and critical strategies that can help in optimizing the benefits while decreasing the dangers entailed.

Selecting the Suitable Offshore Jurisdiction

When choosing an overseas territory for service development, numerous crucial factors must be considered to ensure legal compliance and operational performance. Taxation policies are paramount; some jurisdictions use reduced or zero tax obligation rates, which can be very beneficial commercial retention. One must additionally review the political security of the region to prevent possible dangers that can impact service procedures negatively.

Furthermore, the reputation of the territory can dramatically affect the assumption of the business globally. Deciding for a jurisdiction with a strong regulatory online reputation may facilitate smoother business connections and financial transactions internationally. Furthermore, the convenience of operating, including the simplicity of the enrollment procedure and the accessibility of experienced regional solutions, ought to be assessed to make sure that the operational demands are sustained efficiently.

Understanding Legal and Governing Frameworks

Lawful structures in overseas jurisdictions are frequently developed to attract foreign investment with monetary rewards such as reduced tax rates and simplified reporting procedures. Nevertheless, these benefits can come with rigid laws focused on avoiding money laundering and monetary fraud. Financiers should browse these legislations meticulously to avoid legal pitfalls.

Developing Your Offshore Company Framework

After recognizing the regulatory and lawful frameworks needed for offshore organization operations, the next vital action is to establish the suitable organization structure. Picking the kind of overseas firm is crucial, as this choice impacts administration, obligation, and administrative obligations. Usual frameworks include International Organization Companies (IBCs), Limited Responsibility Firms (LLCs), and partnerships. Each framework uses unique benefits relying on business objectives, such as tax performance, privacy, or adaptability in management.

Selecting the appropriate jurisdiction is just as vital. Factors such as political security, lawful system, and global relations need to be taken into consideration to ensure a beneficial and secure setting for business. Popular areas like the Cayman Islands, Bermuda, and Luxembourg offer different advantages customized to various service requirements, consisting of robust legal systems and desirable governing landscapes.

Inevitably, straightening business framework with critical company goals and the selected jurisdiction's offerings is crucial for enhancing the benefits of offshore consolidation.

Managing Conformity and Taxation in Offshore Operations

Handling compliance and tax is a vital element of keeping an offshore service. Offshore Business Formation. Making certain adherence to the guidelines of the host country, along with global standards, can mitigate lawful threats and boost functional authenticity. Offshore business should remain informed about the tax commitments and reporting demands in their chosen jurisdiction. This includes understanding the implications of double taxes agreements and establishing whether the organization receives any motivations or exemptions.

Entrepreneur must likewise spend in robust compliance programs that include normal more tips here audits and employee training to promote company administration. Engaging with economic and lawful professionals who specialize in international service legislation can give invaluable support and aid browse the intricacies of Click This Link cross-border tax. These experts can help in establishing efficient tax structures that line up with global practices while optimizing monetary obligations.

Eventually, thorough management of compliance and taxation is necessary for making sure the long-term success and sustainability of an offshore venture.

Final Thought

Finally, the successful development of an overseas company hinges on careful factor to consider of jurisdiction, legal compliance, and the appropriate service framework. By thoroughly picking a positive and secure environment, understanding and sticking to legal structures, and taking care of ongoing compliance site web and taxes, organizations can develop themselves successfully on the global phase. This calculated method makes sure not only operational authenticity but also positions business for sustainable growth and long-term success in the international market.

Mara Wilson Then & Now!

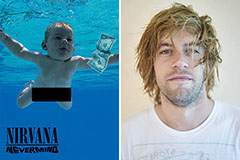

Mara Wilson Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Kane Then & Now!

Kane Then & Now!